PMA Research All-Displays Tracking Shows Improving Sales Through the Distribution Channel in 2020Q2

PMA Research Tracking Shows Distribution Channel Uptick of Flat Panel Display Sales in May

June 25, 2020PMA Research Channel Tracking Shows Best-Selling Projectors in July

August 27, 2020PMA Research All-Displays Tracking Shows Improving Sales Through the Distribution Channel in 2020Q2

San Juan Capistrano, California – July 29, 2020. PMA Research (PMA), the worldwide market information experts on large displays, has published their latest All-Displays sell-through tracking report on professional large-format flat panel displays (32” and larger) and professional projectors (above 500 lumens) being sold by leading U.S. Distributors who serve commercial markets.

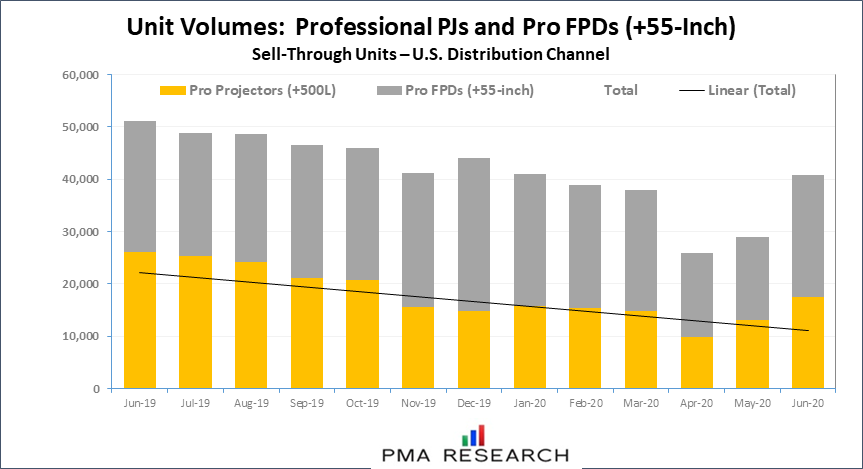

While April and May AV industry sales were hit particularly hard by pandemic related nationwide shutdowns, June rebounded somewhat as many areas around the U.S. reopened for business. Strong K-12 sales of interactive flat panel displays, and interactive projectors lead the June surge. While this is encouraging on a sequential basis, year-over-year comparisons saw 2020Q2 end with volumes and revenues down more than one-third compared to 2Q2019.

June sales of professional flat panels through Distribution were significantly stronger than the prior two months, with a nearly 50% jump in volumes and a more than 40% increase in revenues versus May. Channel partners shared that many projects that were stuck in a holding pattern since the pandemic hit were pushed ahead early in the month as businesses reopened and some school districts were able to begin summer upgrades.

Not surprisingly, year-to-date sales were behind compared with 2019. Volumes were off 2% and revenues off 1% reflecting the strength of the first quarter. New business is still slow although there is design and project work, particularly for dvLED projects, that could help in the third quarter. There’s not much more K-12 education business left, though. Manufacturers and channel partners agree that most of that business was 2019-2020 budget dollars and little of the 2020-2021 budget will be allocated to display technology when there are so many other priorities.

As confidence indicators improved in June so too did projector sales through the Distribution channel. Some on-hold projects were filled earlier in the month as states continued to loosen shut-down restrictions. That contributed to seasonal gains in short-throw, value professional, and 5000+ lumen laser phosphor models. Those gains, however, may be short-lived since many regions registered sharp increases in virus cases starting in the middle of June. This likely means more market volatility going forward.

On a sequential basis, June saw an increase in both projector unit sales and revenues of more than 30% versus May.

The sequential gains are encouraging, and the channel is seeing a rise in requests for quotations. But it is difficult to determine how much of this bidding is strictly for budgeting purposes and how much will translate into actual sales.

About PMA Research

PMA Research (PMA) specializes in worldwide market information for the projector industry, including detailed and comprehensive coverage of High-End Projectors, Mainstream Projectors, and Pico Projectors. With a series of quarterly projector shipment and forecast reports along with monthly sales tracking, PMA publishes data-driven insights for projector manufacturers, component suppliers, accessory companies, and channel partners.

Expanded coverage of the display industry includes market information on U.S. Professional Large-Format Flat Panel Displays. PMA’s Flat Panel Tracking Reports offer timely sell-through data and analysis on unit sales, revenues, and true volume-weighted selling prices of Professional Large-Format Flat Panel Displays sold by leading N. American dealers, systems integrators, and distributors.

PMA Research was formerly Pacific Media Associates, which was established by Dr. William Coggshall. Dr. Coggshall was a co-founder of Dataquest (now part of Gartner) and helped start the syndicated high-tech market information business. PMA Research has offices in the United States, Europe, and Asia. The company’s US headquarters is located at 25852 Avenida Cabrillo, San Juan Capistrano, CA 92675. Phone: +1 (949) 493-4601. www.pmaresearch.com