Economic Disruptions to the Display Market: 2009 vs. 2020

Optoma Unveils Three New Home Entertainment and Gaming Projectors

April 9, 2020

BenQ Debuts Immersive HDR Gaming Projector

May 1, 2020Economic Disruptions to the Display Market: 2009 vs. 2020

There are some similarities between the 2009 global financial crisis and the economic impact due to the COVID-19 health crisis. The differences, however, are significant and mark this as a more serious situation.

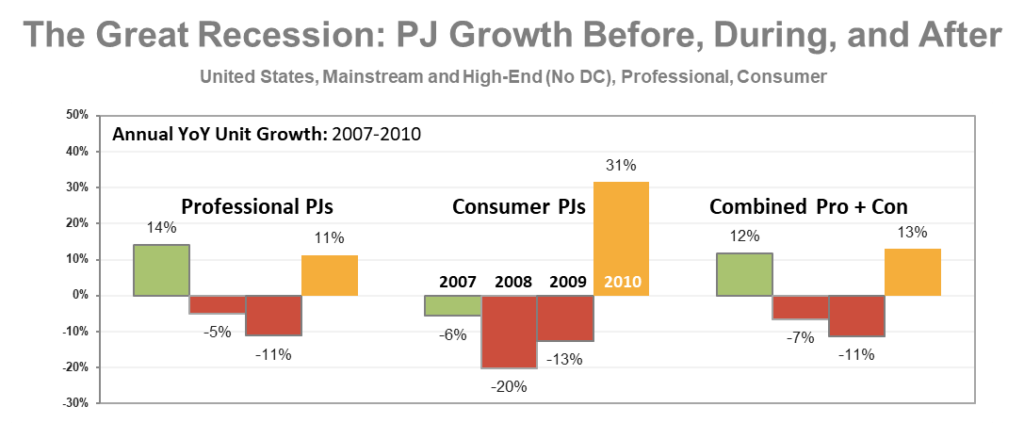

The professional display market, which was almost exclusively projectors in 2008, suffered double-digit declines in 2008 and 2009. Recovery, particularly in the U.S., depended upon huge government stimulus packages directed at the K-12 education market. Consumer spending took even longer to recover as unemployment rates remained high for several years.

In 2008, professional flat panel displays accounted for less than 5% of the total FPD shipments. Consumer televisions and desktop monitors dominated this market. Recovery from the 2020 COVID-19 lockdown will look very different for the professional FPD business and will more likely mirror the projector trends from 2008-2010.

While there are some expected issues with supply, soft demand will be the greater problem. LCD panel prices have been in negative margin territory for several months with no room to lower LCD prices to drive more demand. Although cheaper projector prices could be appealing.

The tailwinds which helped to fuel a quicker recovery in the LCD market in 2009 are no longer relevant today. At that time consumer demand for upgrading televisions was high due to technology advancements such as flat screens, HD and digital broadcasting. Without the benefit of those tailwinds, a slower recovery could result after this crisis.

There are some areas within the LCD market that are showing strong demand. Desktop monitor sales have grown dramatically as companies equip employees to work from home and as people seek entertainment (gaming/streaming) while they stay at home.

Another bright spot is distance collaboration which has grown exponentially during this long shutdown. The ease and effectiveness of video conferenced brainstorming could propel more in-office solutions.

PMA Research continues to track monthly sell-through data and will be reporting sales data, statistics and commentary for projectors and large format (+32”) flat panel displays sold though the U.S. Distribution, Pro AV and Retail channels, and will continue to publish through the COVID-19 crisis and beyond.