Flat Panel Distributor Tracking from PMA Research Shows Positive Growth Trend in 2025

Top-Selling Projectors in March According to PMA Research Channel Tracking

April 23, 2025PMA Research Channel Tracking Reveals Top-Selling Projectors in May

June 25, 2025Flat Panel Distributor Tracking from PMA Research Shows Positive Growth Trend in 2025

San Juan Capistrano, California – May 22, 2025. PMA Research (PMA), the worldwide market information experts on large displays, have published their latest sell-through tracking reports on large-format (32-inch and larger) flat panel displays being sold by leading North American distributors and Pro AV dealers who typically serve commercial markets.

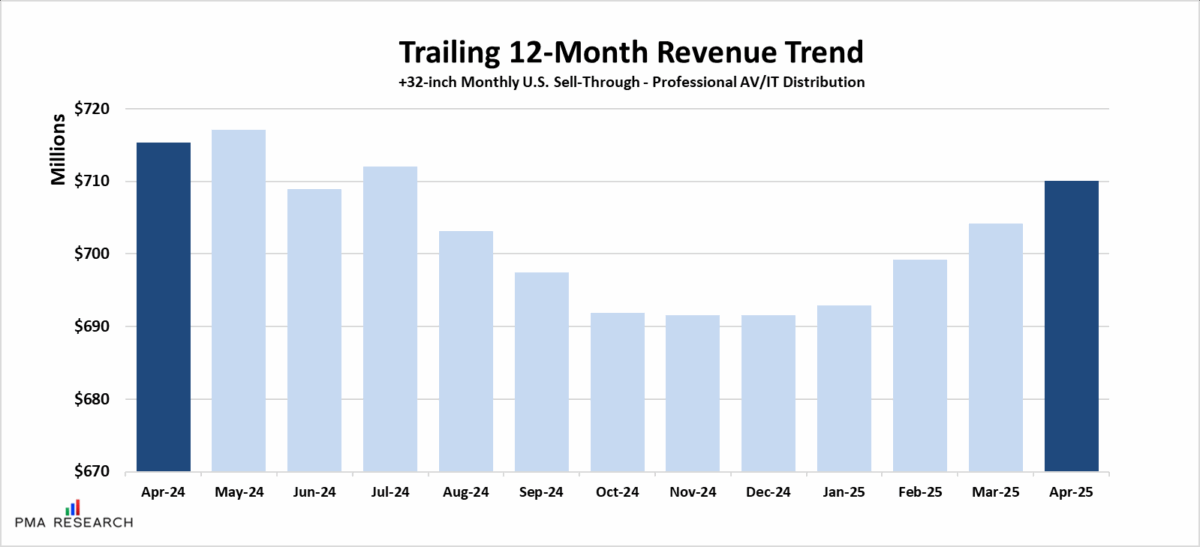

The first four months of 2025 have shown a steady increase in sales of flat panel displays sold through the U.S. Distribution channel. Year-to-date, unit volume is up 5% and revenues up 9% compared with the first 4 months of 2024.

A look at the trailing 12-month revenue trend shows the sales improvements so far in 2025, particularly compared with the downward trends in the second half of 2024. The trailing 12-month analysis removes the seasonal highs-and-lows that occur frequently in the AV displays business.

Tariff uncertainty continued to drive orders from customers looking to lock in prices before the expiration of the implementation pause. Inventories were low for many display brands due to a combination of unexpectedly higher orders and some intentional planning for lower inventory levels at the end of the quarter.

Some of the largest format product segments contributed to sales growth last month. Sales for 98-inch LCD displays grew in April, and year-to-date volumes were 1.5 times higher than January through April 2024. Revenues, however, rose just 3% as the average price has tumbled nearly 30% since April 2024.

Single panel 100- to 105-inch LCD Display sales also added to the year-to-date growth. January 2025 to April 2025 volume was up more than 1.5 times last year’s volume. However, average street prices have been heavily affected by extremely competitive prices from several Chinese brands.

While all this is good news for the display industry, it remains to be seen if this accelerated growth has borrowed from future months and quarters sales, as distributors, integrators, and end-users scramble to secure pricing in advance of the inevitable tariff-fueled price increases the industry is expecting.

PMA’s monthly Flat Panel Distributor Tracking report offers timely sell-through data and analysis on unit sales and market trends of large-format displays sold by leading U.S. AV and IT Distributors. These reports are ideal for tracking product and channel trends.

About PMA Research

PMA Research (PMA) specializes in worldwide market information for the projector industry, including detailed and comprehensive coverage of High-End Projectors, Mainstream Projectors, and Pico Projectors. With a series of quarterly projector shipment and forecast reports along with monthly sales tracking, PMA publishes data-driven insights for projector manufacturers, component suppliers, accessory companies, and channel partners.

Expanded coverage of the display industry includes market information on U.S. Professional Large-Format Flat Panel Displays. PMA’s Flat Panel Tracking Reports offer timely sell-through data and analysis on unit sales, revenues, and true volume-weighted selling prices of Professional Large-Format Flat Panel Displays sold by leading N. American dealers, systems integrators, and distributors.

PMA Research was formerly Pacific Media Associates, which was established by Dr. William Coggshall. Dr. Coggshall was a co-founder of Dataquest (now part of Gartner) and helped start the syndicated high-tech market information business. PMA Research has offices in the United States, Europe, and Asia. The company’s US headquarters is located at 25852 Avenida Cabrillo, San Juan Capistrano, CA 92675. Phone: +1 (949) 493-4601. www.pmaresearch.com